Presentations & Audio from the 2012 London Low-Latency Summit

Bitcoin, the financial traders' anarchic new toy

Podcast - The State of the Art in Low Latency - The Daly Post

Rob Daly is a financial tech journalist who produces the rather excellent Daly Post Podcast. In this most recent edition he asks:

read more...Special Report: The algorithmic arms race

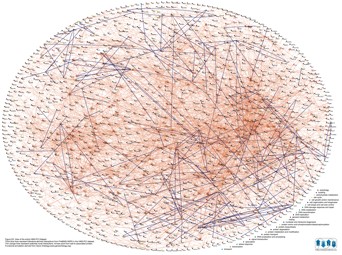

I actually saw David Harding give a talk at the Royal Institution 14-10 Club last year and he threw up a powerpoint slide displaying one of the Winton Capital's strategies. It lwas somewhat more complex than this:

I actually saw David Harding give a talk at the Royal Institution 14-10 Club last year and he threw up a powerpoint slide displaying one of the Winton Capital's strategies. It lwas somewhat more complex than this:

Stanford bioengineers create rewritable digital data storage in DNA

How to Land a Technology Job on Wall Street: Inside an Elite Wall Street IT Education

Capital markets firms are recruiting graduates from the top schools in computer science and other majors to train the next generation of IT talent.

read more...The Microsecond Market

Sophisticated technology now drives global financial trading to extremes of time and space

read more...HFT Review Special Section: FPGA & Hardware Accelerated Trading

Mark Cuban: High-Frequency Traders Are the Ultimate Hackers

This WSJ interview with Mark Cuban has received quite a lot of attention, as well as a Discussion at Slashdot.

read more...Artificial Intelligence, unstructured data and banking scams

New Scientist covers the technology firms who are using Artificial Intelligence to identify behaviours which could indicate improper behaviour:

read more...FIA European Principal Traders Association Market Integrity Framework: Best Practices to Preserve Market Integrity

As part of ongoing efforts to safeguard market integrity, FIA European Principal Traders Association today published a set of best practices to help principal trading firms prevent market manipulation and reduce risks.

read more...Algorithmic Trading Glitch Costs Knight Capital $440 Million

Wired Magazine asks how Wall Street Got Addicted to High-Frequency Trading

The high-frequency trading debate has been polarising opinion for years now, and with little impact on the march of the technologies which are enabling it. Here at MoneyScience, we try not to take a view on the ethics or cultural impact of HFT - we like the evolution of technology as a rule, but dislike speculation when it comes at the expense of markets which would otherwise provide a socially meaningful role. Progress is generally good, we feel - but to paraphrase Spiderman, 'with great power comes great responsibility' - and financial markets as a rule haven't done a great job in recent history of demonstrating they can handle it. We may have the technology to trade ultra-fast, but whether we have the scientific or economic infrastructure to understand and control it is the core of the debate.

read more...DataSift Launches Social Feeds for the Financial Services Industry

Intel and OnX Announce Social Media Hub for the Finteligent Trading Technology Community

Video - Ciamac Moallemi: High-Frequency Trading and Market Microstructure

Ciamac Moallemi is the Barbara and Meyer Feldberg Associate Professor of Business in the Decision, Risk, & Operations Division of the Graduate School of Business at Columbia University.

read more...Video - Trading's evolving next generation? Control systems, feedback loops, adaptive knowledge capture

SEC-mandated XBRL data at risk of being irrelevant to investors and analysts

In 2009, the Securities and Exchange Commission mandated that public companies submit portions of annual (10-K) and quarterly (10-Q) reports—in a digitized format known as eXtensible Business Reporting Language (XBRL). The goal of this type of data was to provide more relevant, timely, and reliable "interactive" data to investors and analysts. The XBRL-formatted data is meant to allow users to manipulate and organize the financial information according to their own purposes faster, cheaper, and more easily than current alternatives.

read more...Video: Larry Tabb on The Future Of Data Management in a post-Crisis World

Larry Tabb of TABB Group recently discussed with Wall Street & Technology senior editor Melanie Rodier how firms are adapting their data management processes to the post-financial-crisis environment.

read more...